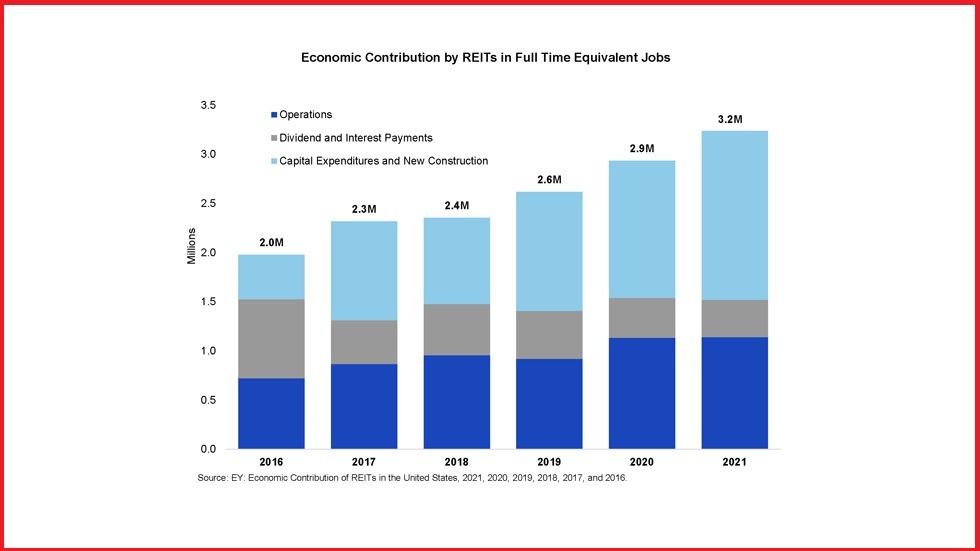

An estimated, there are more than 2.6m jobs available in REITs.

According to Nariet research: 3.2 Million Jobs Supported By REITs (September 2022)

A real estate investment trust is a way for a group of investors to pool their resources. And undertake real estate investments on a scale that they often cannot do on their own. Volume and critical mass naturally lead to competent portfolio management. It allows for the adoption of suitable asset diversification, making them the essential elements of real estate success. The REIT enables small investors to take part in real estate transactions of reasonable size in this way. Real estate investment trusts (REIT) continue to see exponential expansion at the same time that the real estate sector is experiencing daily growth.

Real estate that generates revenue on a large scale can be purchased through Real Estate Investment Trusts REIT.

A business known as a REIT often owns and manages income-producing real estate or associated assets. These structures could be workplaces, malls, residences, lodgings, vacation spots, self-storage facilities, warehouses, or even mortgages or loans. REIT doesn’t create real estate properties for resale like other real estate businesses do. Instead, REITs make real estate acquisitions and primarily develop them with the intention of operating them as a part of their private investment portfolio.

Real estate investment trusts offer a range of professions, including those in asset management, finance, and operations. With such a sizable and expanding business, you can be sure to find the ideal career.

REITs enable individuals to own a portion of a diverse real estate portfolio consisting of residential and commercial leases as well as construction projects.

This industry has a sizable market, and within it, there are numerous roles to choose from. Each with its own set of salaries and career opportunities. The way it works is that the company pools the capital of investors. It allows individual investors to earn dividends from real estate investments without having to buy or manage them themselves. In other words, Real Estate Investment Trusts can provide investors with a consistent income stream.

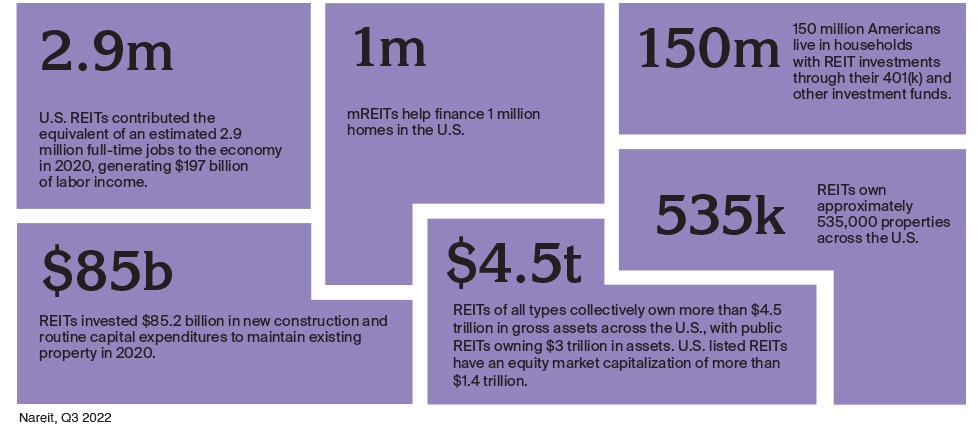

The answer to the question of how many jobs are available in real estate investment trusts can be found in a REIT analysis, which states that REIT organizations employ 307,000 people full-time. Similarly, real estate investment trusts indirectly support nearly 3.2 million full-time jobs in the United States.

Asset management jobs are the most common in real estate investment trusts. Asset managers are in charge of a property’s day-to-day operations as well as its long-term strategic planning.

They collaborate with tenants, landlords, and other stakeholders to keep the property in good condition and profitable. Portfolio managers are in charge of a company’s entire real estate portfolio. This includes all types of properties, such as office buildings, retail centers, apartments, and warehouses. Portfolio managers collaborate with asset managers to ensure that each property performs to its full potential. Acquisitions and Development jobs are in charge of locating and purchasing new properties for the REIT to invest in. It includes working with brokers, developers, and other stakeholders to identify potential opportunities.

Economic Contribution of REITs

Highlights

◼ The economic contribution of REITs in 2021 was 3.2 million FTE jobs.

◼ REITs directly employed 307,000 FTE employees.

◼ REITs invested $107.5 billion in capital expenditures for new construction and to maintain and upgrade existing properties

| REIT Activity | Direct | Indirect & Induced | Total |

| Operations | |||

| – Labor income | $22.7 | $61.1 | $83.8 |

| – Employment | 307 | 834 | 1,140 |

| Dividend and interest payments | |||

| – Labor income | $0.0 | $26.1 | $26.1 |

| – Employment | 0 | 380 | 380 |

| Construction | |||

| – Labor income | $58.6 | $60.5 | $119.1 |

| – Employment | 861 | 854 | 1,716 |

| Total | |||

| – Labor income | $81.2 | $147.7 | $229.0 |

| – Employment | 1,168 | 2,068 | 3,236 |

Data Source: September 2022 Research by NaREIT

What is REIT and its Type

A real estate investment trust (REIT) is a business that owns, manages, or finances income-generating real estate. REITs pool the capital of multiple investors to buy property portfolios, which frequently include office buildings, shopping centers, apartments, and warehouses. REIT shareholders receive regular dividend payments based on the income generated by these properties.

Publicly traded REITs must pay out at least 90% of their taxable profits to shareholders in the form of dividends.

REITs can be traded publicly on major stock exchanges or sold privately. Publicly traded REITs must pay out at least 90% of their taxable profits to shareholders in the form of dividends. This makes them appealing income vehicles for investors looking for consistent cash flow. Private placements are not required to make dividends to shareholders, but they may provide tax benefits and greater control over the underlying real estate assets.

- Equity REITs

These are REITs that invest in properties such as offices, residential complexes, industrial estates, and hotels. They acquire, manage, build, and sell real estate and pay out the majority of their profits to shareholders in the form of dividends. Rentals and property sales can both generate income. When we talk about REITs, we usually mean equity REITs.

- Mortgage REITs

These REITs make loans to homebuyers or acquire existing mortgages. They are also referred to as mREITs. The majority of their income comes from the interest on these mortgage loans. They are similar to debt-investing mutual funds. Of course, the risk factor is higher than in a debt fund. Some mREITs may even work in HELOCs, which is like a title loan but for real estate.

- Retail REITs

These are REITs that invest in retail properties such as shopping malls, grocery stores, and supermarkets. However, REITs are not directly involved in the operation of these retail outlets. They simply lease the space to retail tenants. The performance of these REITs is entirely dependent on the state of the retail sector. So, if there is a retail boom, you know where to put your money.

- Residential REITs

Residential REITs own and operate residential properties such as apartment buildings and gated communities. Given the high interest in residential property, this could be a future growth area.

- Healthcare REITs

These, like retail REITs, invest in property for hospitals, medical centers, and clinics. Because the demand for healthcare services will continue to rise in the future, this type of REIT represents an excellent investment opportunity.

The Hype About REIT

REITs are popular for a number of reasons. They provide investors with several advantages, including the ability to expand their portfolios, generate profits, and access a wide range of real estate investments. There are several different types of REITs available to investors, giving them the freedom to select an investment that meets their specific goals and needs. Some REITs, for example, invest in residential properties, whereas others invest in commercial real estate.

REITs also provide investors with the opportunity to earn income. Most REITs distribute a portion of their earnings as dividends, providing investors with a consistent stream of income. Furthermore, REITs frequently provide shareholders with the opportunity to participate in the appreciation of the underlying asset.

Finally, REITs provide investors with access to a wide range of real estate investments in which they might not otherwise be able to invest. Some REITs, for example, concentrate on specific industries such as healthcare or self-storage. Others invest in properties in specific geographical areas. Investing in a REIT allows investors to gain exposure to a diverse range of real estate assets without having to buy and manage them directly.

Is REIT a Good Investment

REITs provide a distinct opportunity to invest in large-scale commercial real estate projects without having to do the development or management yourself. REITs pool the resources of multiple investors to buy, finance, and manage real estate on their behalf. REIT investors receive several benefits in exchange for this professional management. According to statistics, approximately 145 million Americans have purchased REIT equities. REITs provide numerous benefits, including the following.

- Enables investors to profit from real estate market growth without making direct property purchases.

- Allows for some degree of independence from S&P 500 performance.

- Customers appreciate dividend yields.

- Easy liquidity benefits investors.

- Have advantageous tax laws, which allow real estate businesses to pay less in capital gains taxes and corporate taxes.

Real estate investment trusts come in a variety of forms, but the majority of them are set up as pass-through entities for federal income tax purposes. This means that the trust is exempt from paying corporate taxes on the income generated by its real estate holdings. Instead, the trust’s earnings are taxed to the trust’s shareholders.

The primary benefit of investing in a real estate investment trust is that it allows you to invest in large, professionally managed real estate portfolios without having to purchase or manage individual properties. Another benefit is that REITs are less volatile than stocks, providing some stability in your portfolio.

REITs, on the other hand, have some drawbacks. One is that they do not typically provide the same potential for capital appreciation as individual properties. Another disadvantage is that they frequently have high expenses, which can eat into your profits. Finally, REITs typically do not provide the same level of control or flexibility as individual property ownership.

What is Requires To Be A REIT

Most REITs have a simple business model. The REIT leases space and collects rent on the properties, then distributes the income to shareholders as dividends. Mortgage REITs do not own real estate, but rather finance it. The interest in their investments generates income for these REITs.

A company must follow certain provisions of the Internal Revenue Code in order to qualify as a REIT (IRC). These requirements include the long-term ownership of the income-generating real estate and the distribution of income to shareholders. To qualify as a REIT, a company must meet the following requirements.

- Beneficial ownership in the organization must be held by at least 100 people for at least 335 days during the fiscal year or a proportionate portion of the fiscal year. The days do not have to be consecutive, and the requirement does not have to be met in the first year the entity is treated as a REIT.

- Transferable shares or certificates of beneficial interest must be used to demonstrate beneficial ownership.

- One or more trustees or directors must be in charge of the organization’s management. The trustees have legal title to the organization’s property and have sole authority over management.

- Except for the REIT provisions, the organization must have all other necessary characteristics to be taxed as a domestic corporation.

- During the last half of the organization’s tax year, no more than five individuals may directly or indirectly own more than half of the value of the organization’s stock. This would result in the formation of a personal holding company. For the purposes of this requirement, certain constructive ownership rules apply. If a REIT does not know, or would not have known if it had exercised reasonable diligence, that it has failed to meet this requirement, it is considered to have met the requirement as long as it follows the rules for determining its actual owners.

- The company cannot be a financial institution or an insurance company.

- The organization must meet certain income and investment requirements.

- The company must distribute to its shareholders at least 90% of its taxable income for the tax year.

- The organization must make an election to be treated as a REIT by calculating its taxable income as a REIT and filing Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts, for the first tax year in which the election is to be effective.

- A REIT is required to keep records sufficient for the IRS to determine who owns the REIT’s shares. A REIT must annually request information about actual stock ownership from certain shareholders.

REITs Taxation

REITs are a way for investors to own income-generating real estate without having to buy or manage the property themselves. REITs are popular among investors due to their high yields. The trust must distribute at least 90% of its taxable income to shareholders in order to qualify as a REIT. In turn, because their earnings are distributed as dividends, REITs typically do not pay corporate income taxes. REIT dividends have special tax implications for investors. These payments can be classified as ordinary income, capital gains, or capital returns, each of which is taxed differently.

A REIT is a tax-exempt entity that would be taxed as a corporation if it did not have the special REIT status. As stated before, to be classified as a REIT, the majority of its assets and income must be derived from real estate. Furthermore, it must distribute 90% of its taxable income to shareholders.

As a result of this requirement, REITs typically do not pay corporate income taxes, though any retained earnings are taxed at the corporate level. A REIT must invest at least 75% of its assets in real estate and cash. And generate at least 75% of its gross income from sources like rent and mortgage interest.

- Ordinary dividends account for the majority of dividends paid by most REITs. They are derived from the taxable income of a REIT and are taxed as ordinary income at the investor’s marginal tax rate.

- When a REIT sells real estate assets for a profit, capital gains distributions are made. Unlike ordinary dividends, these distributions are taxed at preferential rates and treated as capital gains.

- Distributions that exceed a REIT’s profits result in a return of capital. ROC distributions are not taxed at the time they are received, but instead reduce an investor’s cost basis, deferring taxes until the shares are sold. ROC is usually not a cause for concern because a REIT’s taxable income is reduced by non-cash depreciation charges.

Types of Job Available in REITs

Property management, development, asset management, and business research are some of the highest-paying occupations in real estate investment trusts. In terms of how many jobs are accessible in real estate investment trusts, the answer is undoubtedly dependent on the country’s economic situation. There are various types of REITs, but if the economy suffers, the real estate market will naturally stall. Some jobs, however, will always be available because the property must be managed regardless of the economy. Let’s explore a few of the highest-paid jobs within REIT.

- Leasing Consultant

You will be dealing with tenants on behalf of landlords as a rental property specialist. Tenants can be difficult to find in their search for the right property, so the leasing consultant must have strong interpersonal skills. They must be able to summarize the tenant so that they can match the client to the appropriate types of properties that are available.

A leasing consultant’s responsibilities will include managing all leases, arranging for property viewings, marketing rental listings, executing new lease agreements, negotiating lease terms with the landlord, preparing all paperwork, and managing regulatory services, among other things. A leasing consultant will need a real estate license, a good understanding of rental regulations and compliance, a solid understanding of rental agreements, and proficiency with property management software.

- Asset Management

Asset Management positions continue to be among the highest-paying jobs in the REITs industry. These individuals are in charge of the financial and operational performance of a REIT’s portfolio assets. In most cases, becoming an Asset Manager requires a background in acquisitions or property management. However, if you have all of the necessary skills and qualifications, you can directly apply for Asset management positions.

An asset manager’s job entails working with people from the finance, accounting, and acquisition departments. Asset managers oversee both the day-to-day operations of a property and its long-term strategic planning. To keep the property in good condition and profitable, they work with tenants, landlords, and other stakeholders.

- Property Development

This ever-changing industry has a high demand for property developers. So, if you are looking for high profits in the real estate trusts sector, property development might be your best bet. These individuals plan and supervise the construction of new properties.

A degree in disciplines such as architecture, estate management, urban planning, or civil engineering is required to land a role as a real estate developer. Strong real estate market insider knowledge, financial expertise, and exceptional organizational skills are additional benefits for landing the role.

- Property Management

Property managers are similar to REIT property developers. The only difference is that to become a property manager, you must meet fewer requirements than a property developer. Property managers in the real estate industry are primarily responsible for prospecting and collaborating with clients in order to sell or rent properties at the best market rate. To get a job as a property manager in the real estate investment trusts industry, you must have strong communication, customer service, marketing, finance, management, and problem-solving skills.

- Facility Manager

Facility management is an important career path for anyone who enjoys the idea of maintaining and improving buildings. It is not the same as being a property manager, though the two have many things in common, one of which is keeping buildings secure and safe. However, responsibilities will vary depending on the size of the portfolio of buildings. The facility manager represents the real estate owner and must consider things like when to sell and how the expenses for a specific building compare to other buildings in the portfolio.

The facility manager is basically a jack of all trades who maintain buildings and thus requires basic financing and accounting knowledge to determine when to suggest infrastructure investments. As time passes, it becomes clear that both the property and facility manager cannot simply sit back because these jobs necessitate ongoing education. Certainly, someone in this field entering the REIT industry needs a solid understanding of real estate management as well as completion of a property administrator course. This is due to the fact that you must always be a well-rounded property manager or facility manager.

- Real Estate Managing Broker

People frequently mistake a Real Estate Managing Broker for a real estate agent, but this is not the case. The broker is a licensed real estate professional who is eligible to oversee a large real estate office. You must be sharp to arrange real estate transactions, and you must be licensed to organize contracts and oversee transactions for buying and selling property.

A managing broker in real estate holds a higher-level license than a real estate agent. In some states, every real estate professional is licensed as a broker, but even if you are licensed as an independent broker, you must obtain another higher-level license in order to hire agents or even other brokers.

Brokers cannot allow untrained agents to work for them because there is a significant risk of liability and penalties. Because of the risks involved in running a brokerage, brokers are responsible for both educating and monitoring their agents.

- Investor Relation Management

An investor relations manager’s role in a REIT is to engage with REIT shareholders and manage overall communication. These professionals are in charge of organizing end-of-year meetings as well as preparing end-of-year proxy and report statements. Roles in the investor relations sector pay very well, but you must have a degree and a strong knowledge of finance and accounting to land these positions.

- Property Appraiser

A real estate appraiser offers an objective and unbiased estimate or appraisal of a property’s value. Appraisals are prepared for a variety of purposes, including lease negotiations, mortgage lending, and tax assessments. To determine the value of a property, appraisers examine its features and compare it to similar properties.

You must complete an appraiser training course and be certified to work as a real estate property appraiser. You may have a competitive advantage if you also have a background in real estate, finance, economics, and other relevant disciplines.

- Real Estate Investor

Do you want to be one of the top earners in the REIT industry? If so, you should think about becoming an investor. A real estate investor primarily acquires real estate assets, increases their value, and resells them at a profit. Much is expected of those to whom much is given. This is a real estate investor’s situation.

To stand out and reap all of the benefits, you must thoroughly understand how the business operates, particularly when the best time to sell is. To succeed here, you must have a strong understanding of market research.

- Investment Strategist

A Property Strategist can assist you in the selection and purchase of a home. They are experts at identifying areas and properties with the best opportunities by using their market analysis knowledge. The job of a property strategist does not end there. They will also keep you updated on the status of your investment and advise you on how to expand your property portfolio.

A good strategist is always aware of market trends and understands how to identify opportunities to expand your portfolio. They are knowledgeable about consulting, sectional titles, property contracts, and the entire real estate sales process. Among other responsibilities the Property Investment Strategist’s responsibilities include, assisting property investors in building their property portfolios, contracts, financial planning, dealing with high net worth clients, investments, selling new development properties to investors, and property sales.

- REIT Analyst

A real estate investment trust analyst works with the real estate and finance teams to acquire, sell, market, and finance properties. The REIT analysts are in charge of researching, analyzing, and monitoring market trends. As a real estate investment trusts analyst, you are in charge of preparing underwriting for real estate properties in a portfolio based on projections, market research, and previous financial statements to determine income, valuations, and loan amounts. Because of the expertise of a REIT analyst, organizations make informed property decisions.

Video: How Many Jobs are Available in Real Estate Investment Trusts? 💡

Statistics of Real Estate Industry Jobs

According to the US Department of Labor and mentioned by ceomichaelhr.com, there is a sustained high demand for property managers, real estate brokers, and sales agents. In 2022, the average annual wage in the real estate industry will be $51,220, with hundreds of thousands of people employed across the United States. The average salary in the REIT sector far outstripped that of traditional real estate brokers.

As of November 2022, the average Real Estate Investment Trust analyst earned $108,164 per year, which is more than double the number of real estate brokers and sales agents. The salary range, however, is generally between $76,495 and $145,071. wREIT organizations employ 307,000 people on a full-time basis. Real estate investment trusts are estimated to generate 3.2 million full-time jobs indirectly.

If you are thinking about working for a REIT, there is good news. The industry is expanding rapidly. As a result, there are many job opportunities and the ability to earn a higher salary than in other areas of the traditional real estate industry.

Where To Find REIT Jobs

Real estate is one of the world’s largest professions, with over 500,000 agents in the United States alone. However, before you can become a real estate agent, you must meet state-specific age, education, and licensing requirements. Then you have to look for work.

Trying to break into a new industry can be daunting at times. As a result, we have compiled a list of the best job boards for aspiring real estate agents looking for a new job.

The website has a massive job posting database, crawling the internet to collect over 11,000 real estate jobs. Users can perform keyword searches, filter listings by title, city, and state, and browse real estate jobs by function or location.

It is one of the world’s largest job sites, so it’s no surprise that it has a large number of real estate opportunities. Indeed serves as a resource for both employers and job seekers. Applicants can “get found” by uploading a general resume, while employers can list on the site and search through posted resumes.

LinkedIn, another employment behemoth, has a massive database of available real estate jobs. There are approximately 478,317 jobs available in the real estate sector worldwide. But don’t be alarmed by this figure. LinkedIn’s powerful filters can narrow down nearly 500,000 jobs by location, company, job function, experience level, and job title.

Select Leaders receives 450,000 annual applications through the website and has 225,000 registered members. Members can sign up for job alerts and a weekly “Select Jobs” newsletter, which compiles “8-10 of the most intriguing jobs” recently posted, for free. They power the Career Centers for nine major industry associations, the members of which control or direct 90% of commercial real estate.

Best YouTube Channels for REITs Professionals

Youtube is an excellent educational resource for people who have a busy schedule and prefer to learn on the go, as well as for people who are visual learners and prefer to learn by watching short, informative videos.

Graham Stephan tops the list of real estate YouTube channels to follow in this generation. With over 4 million subscribers and over 600 uploads.

Graham began his real estate career at the age of 18 and has since sold over $120,000,000 in residential real estate. Graham, now 30, is a millionaire who makes videos about his success, failures, and experiences. On his channel, he likes to talk about how investing could help to create wealth for the future. How investing is a source of passive income. And he shares some tips and tricks about remodeling and renovating including some real estate agent strategies.

Top Video

Grant Cardone, arguably one of the most successful real estate YouTubers, is the founder and manager of Cardone Capital, a real estate investment firm with approximately $1 billion in assets.

Cardone has also written eight business books, created thirteen business programs, and served as CEO of seven privately held companies. Forbes recently named him one of the world’s top social media business influencers. On his channel, he discusses,

- Marketing and lead generation

- Investment hints and tips

- Book evaluations

- Motivational ideas

- Lessons on how to improve your sales skills

Top Video

The Youtube channel is a real estate investment guide founded in 2004 by entrepreneur Joshua Dorkin in Denver, Colorado. Bigger Pockets is arguably the best YouTube channel to learn about real estate investing and strategy, with nearly 900,000 subscribers and over 1,500 video uploads. Their channel provides unique and fresh content on every aspect of real estate investing, including analyzing deals, finding and financing properties, tips and advice, and much more.

Ending Notes

Real estate investment trusts (REITs) have a surprisingly strong job market, with a wide range of positions available. Asset management and acquisitions are the most common jobs, but there are also many opportunities in operations, finance, accounting, and law. REITs provide an excellent opportunity for those considering a career in real estate. The industry is rapidly expanding, and qualified professionals are in high demand. With a little research, you should be able to find a position that perfectly matches your skills and interests.

Published on

Last updated:

January 17, 2023