Whether you are bootstrapped or venture backed, burn rate is arguably one of the most important metrics for startups to deeply understand. It measures the rate at which a company is spending its cash reserves to finance overhead, growth, and other operating costs before generating positive cash flow. Tracking burn rate allows startups to gauge their financial health, forecast their cash runway, and make strategic spending decisions. This comprehensive guide will demystify burn rate by explaining what it is, how to calculate it, strategies to optimize it, and why it matters.

What Exactly is Burn Rate?

Burn rate refers to the net amount of cash a company is spending over a defined time period, usually calculated on a monthly basis. It represents the rate at which a startup is burning through its cash balances and capital as it works towards profitability and scaling up operations.

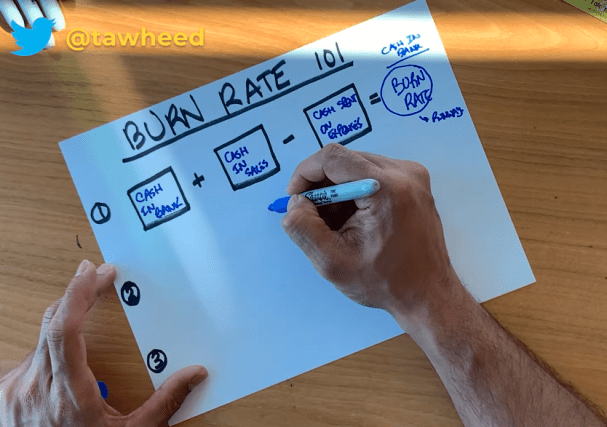

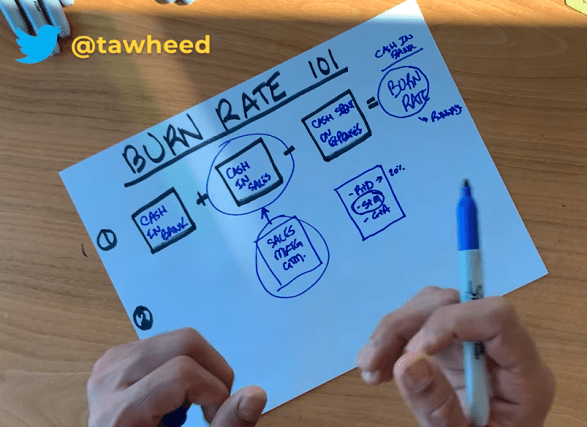

Burn rate is calculated by taking the beginning cash balance, adding net cash inflows, subtracting the ending cash balance, and subtracting net cash outflows over a set time period. The basic formula is:

Beginning cash balance + Net cash inflows – Ending cash balance – Net cash outflows = Burn rate

If a company’s burn rate is negative, it means the business’ outflows exceeded inflows and it burned through cash over the measurement period. A positive burn rate indicates that the company added to its cash reserves for that period.

Burn rate helps startups determine their “cash runway” – an estimate of how many months a company can sustain operations based on current cash balances and spending. Runway is calculated by dividing cash in hand by the average monthly burn rate.

Step-by-Step Guide to Calculating Burn Rate

Figuring out your startup’s burn rate takes just five steps:

1. Define the Relevant Time Period

Burn rate can be calculated for any time period – daily, weekly, monthly, quarterly, or annually. Most startups track burn rate monthly as this offers a regular snapshot of their cash spending. Choose the cadence that aligns with your financial planning needs.

2. Record Starting Cash Balance

Note down all cash available at the beginning of your selected time period. This includes balances across bank accounts, petty cash funds, and any other cash equivalents. Be comprehensive by including global subsidiary accounts.

3. Calculate Net Cash Inflows

Add up all sources of cash that flowed into the business during the period. Typical startup inflows include revenue from sales of products or services, capital raised from investors, debt financing, interest income, tax refunds, and any other monies received. Only include actual cash received – not accounts receivable.

4. Calculate Net Cash Outflows

Total up all cash spending that occurred during the period. For startups, outflows typically include operating costs like payroll, cloud services, marketing expenses, lease payments, equipment, etc. Again, only tally actual cash paid out.

5. Record Ending Cash Balance

Note down cash available at the end of the period across bank and other cash accounts. This is used to derive net cash flow.

Plug all the amounts into the burn rate formula to calculate the net change in cash for the period. Compare burn rates month-over-month or quarter-over-quarter to spot trends.

Best Practices for Tracking Burn Rate

Here are some tips for accurately tracking your startup’s burn rate:

- Maintain detailed accounting records – Capture every cash inflow and outflow. Inflows from customers may require system integration with CRM and billing tools. Reconcile accounts frequently.

- Take snapshots at consistent intervals – Set calendar reminders to record starting and ending balances on the same day each period. This ensures consistency.

- Annualize large one-time payments – Occasional lump sum payments like insurance premiums should be allocated evenly across months to normalize the impact.

- Factor in reserves – If maintaining rainy day funds or reserves, exclude these from ending cash balances used in burn rate calculations.

- Use rolling averages – Average burn rate across 3-6 months to smooth out monthly fluctuations for a more useful trendline.

Optimizing Your Startup’s Burn Rate

Since burn rate directly impacts a startup’s cash runway, taking steps to optimize it is essential. Here are proven strategies:

Right-size headcount – Tie number of full-time employees to revenue metrics like ARR per employee. Hire cautiously.

Extend payables – Renegotiate payment terms with vendors/suppliers to improve cash conversion cycle.

Analyze discretionary spend – Identify and eliminate unnecessary variable costs that are not fueling growth.

Delay large capital expenditures – Prioritize must-have capex based on ROI and defer other purchases.

Offer discounts for early payment – Incentivize customers to pay invoices ahead of schedule so cash inflows improve.

Renegotiate contracts – Lower fixed costs by renegotiating with vendors, landlords, consultants, etc.

Invest in go-to-market – Allocate spending to high-ROI growth drivers like sales, marketing, customer success.

Make data-driven decisions – Let burn rate metrics and cash runway forecasts guide budgeting and spending.

With constant monitoring and decisive actions, startups can significantly extend their runway and reduce reliance on capital. The goal should be to build an efficient cash engine, where every $1 in expenses yields >$1 in incremental revenue.

Why Tracking Burn Rate Is So Important

Here are some reasons why burn rate deserves startups’ unwavering focus:

- It quantifies a startup’s dependence on investor funding for sustaining operations. A high burn rate equals greater reliance on external capital.

- It helps forecast cash runway based on historical spending patterns and growth plans. Runway determines financing needs.

- It allows modeling different scenarios to extend the cash runway, like reducing staff or cutting variable spend.

- It highlights periods of heavy spending that may require revisiting budgets and priorities.

- It can provide an early warning signal if the startup is burning through cash reserves too quickly. Proactive course correction is enabled.

- It helps demonstrate management’s ability to judiciously allocate resources and control costs. Investors will look for this.

- It supports valuations during funding discussions by quantifying operational efficiency and financial health.

In summary, burn rate is a critically important metric that all startups need to calculate, track, and optimize. Meticulous monitoring of cash outflows versus inflows and taking prompt actions enables startups to extend their runway and avoid risky cash crunches. While growth needs investment, prudent spending and efficient operations are vital for long term success.